estate tax change proposals 2021

This last week House Democrats released details of a new tax proposal to support the 35 trillion. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

Canadian Tax News And Covid 19 Updates Archive Cpa Canada

The various tax proposals could have significant estate implications including.

. Proposals to decrease lifetime gifting allowance to as low as 1000000. The proposal seeks to accelerate that reduction. I the reduction of the current 117 million gift and estate tax exemption to about 603 million will be effective January 1.

So if a resident. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Reducing the gift and estate exemption amount to 35M per taxpayer and 7M per married.

The gift estate and GST generation skipping transfer tax exemptions are 117 million per person adjusted. Then the gift and estate tax exemption is lowered from 117 million to 35 million with the gift and estate tax rate increased from 40 to 45 all retroactively effective January 1. The exemption was indexed for inflation and as of 2021 currently.

No cash may be dropped off at any time in a box located at the front door of Town Hall. If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of. As of January 1 2021 the death tax exemption in Washington DC.

The 2021 exemption is 117M and half of that would be 585M. Tax and sewer payments checks only. And while the gift and estate tax exemption is scheduled to drop to approximately one-half the current amount on January 1 2026 there also are tax proposals in play that could.

5376 by Congressman John Yarmuth. Reducing the estate and gift tax exemption to 6020000. That is only four years away and.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Decrease in Exemptions on State Death Taxes. Decrease in the Gift Estate and GST Tax Exemptions.

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. Well work closely with your tax advisor and attorney to prepare your investment plan. The proposed legislation would cause the increased exemption to expire at the end of 2021 instead of 2025.

President Bidens Build Back Better plan. Here are some of the possible changes that could take place if Sanders proposed tax changes become law. To pay your sewer bill on line click here.

Thankfully under the current proposal the estate tax remains at a flat rate of 40. Learn How to Administer an Estate Manage Probate and Distribute Assets. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion.

The law would exempt the first 35 million dollars of an individuals. The current 2021 gift and estate tax exemption is 117 million for each US. New federal tax legislation is on the horizon with significant changes for estate and gift taxes.

This Alert focuses on the changes that directly impact common estate planning strategies. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. On September 27 2021 the Build Back Better Act was introduced into the House of Representatives as HR.

In recent weeks this. Decreased from 567 million to 4 million. Ad Step-By-Step Guides to Help Administer the Estate and Avoid Tax Penalties.

2021 Estate Tax Proposals. These changes would be effective January 1 2022 except for the capital gains increase which would be effective as of the date of the proposal September 13 2021. The effective dates in the House Proposal differ.

The maximum estate tax rate would increase from 39 to 65. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

What S In Biden S Capital Gains Tax Plan Smartasset

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman Jdsupra

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

As Climate Risks Skyrocket Largest Asset Managers Vote For More Climate Related Shareholder Proposals Tipping Support To Record Levels In 2021 Ceres

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Tax Proposals Comparisons And The Economy Tax Foundation

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Proposed Tax Changes For High Income Individuals Ey Us

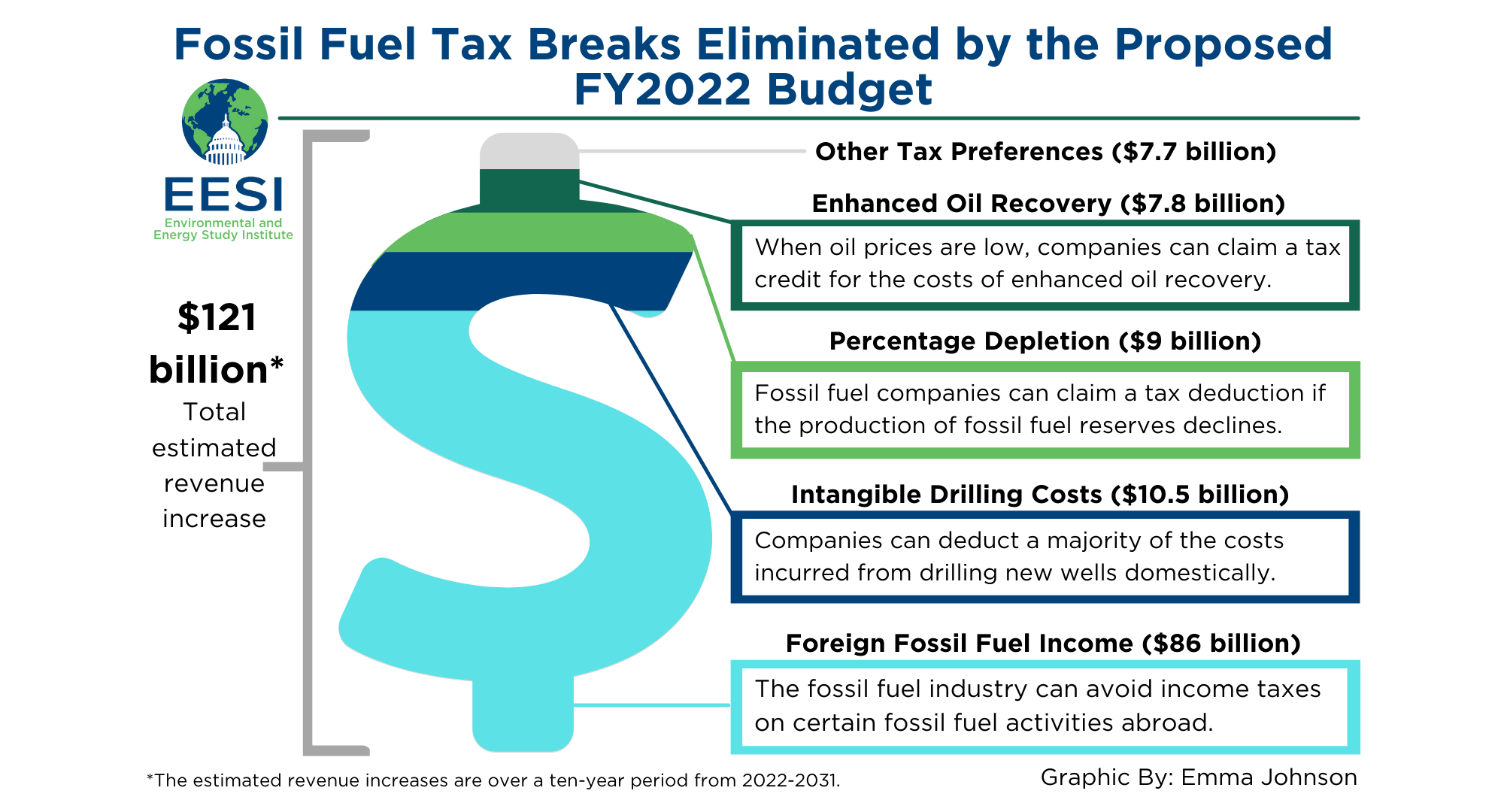

Fact Sheet Proposals To Reduce Fossil Fuel Subsidies 2021 White Papers Eesi

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

2021 Voter S Guide Climate Change Analysis Generation Squeeze

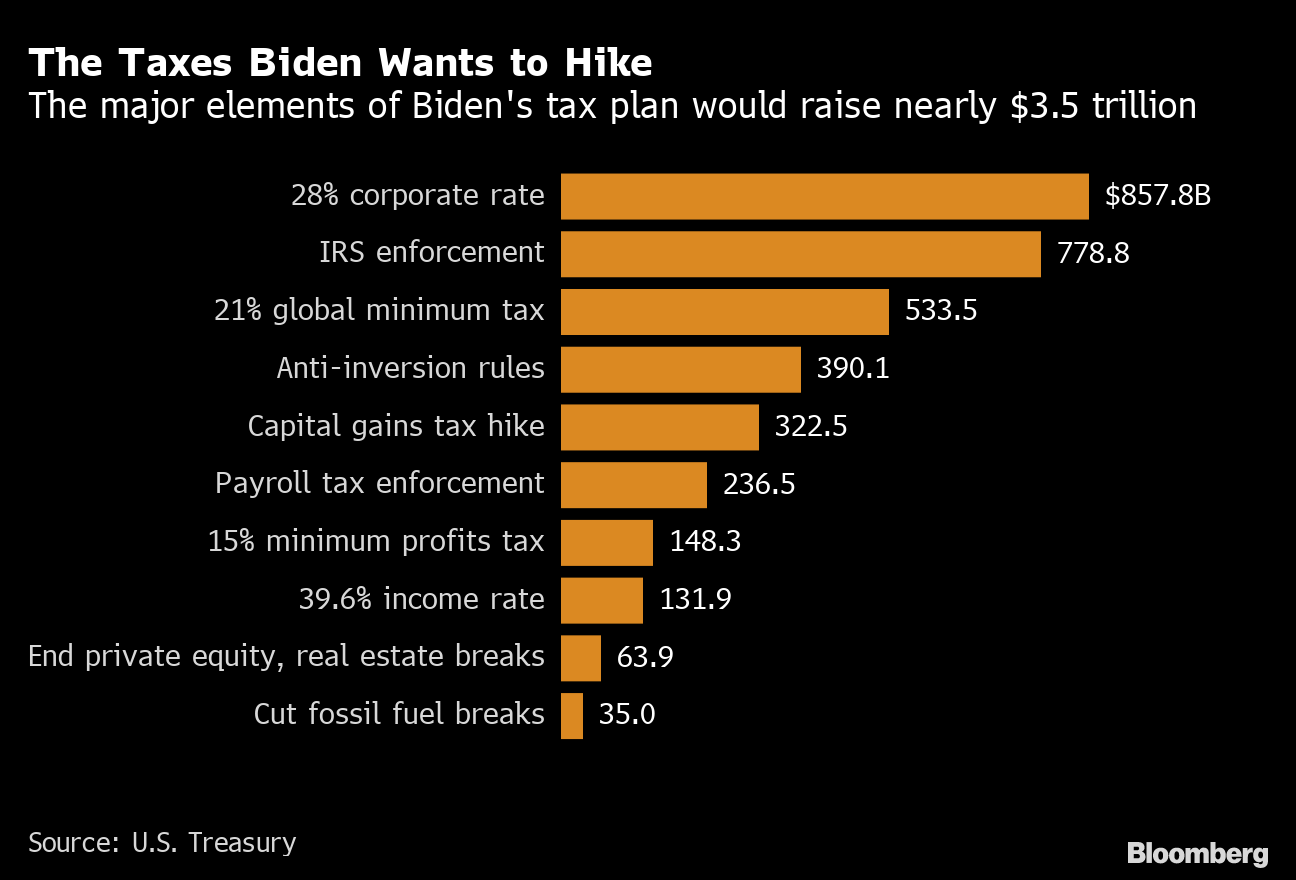

Biden Budget Biden Tax Increases Details Analysis

When Taxes Are Due And Other Things To Know About Your 2021 Income Taxes Moneysense